Investing in Public REITs vs. Private Real Estate

So, you want to invest in commercial real estate?

Why would you do such a thing? And how will you go about it?

Why Commercial Real Estate Should Be Part of an Investor’s Portfolio

I am in my third decade as a professional real estate investor. Even before I started down this path, I noticed that most of the wealthiest and most successful investors gravitated away from residential and toward commercial real estate.

Study the Forbes 400 wealthiest Americans, and you’ll discover that some made their fortunes in this realm. And we believe many of them invest in commercial real estate as part of their strategy to protect and grow their wealth.

Those who are both wealthy and bright realize that true wealth isn’t found in expensive cars and clothes and yachts and mansions. These are often symbols of wealth. But not true wealth itself. True wealth is owning assets that produce income. And commercial real estate is widely viewed as an income producing asset class.

So, how is real estate valued?

The value of residential real estate is primarily based on comparables (market comps). Let’s say you buy a flip house for $150,000. You add top-end fixtures. You build out the basement and the attic. You add a large garage, high-end fencing, and custom lighting. You spend $400,000 and hope to sell for half-a-million-dollars, right?

Maybe.

But if you’ve acquired and upgraded this home in a neighborhood of $300,000 houses, your appraised value will likely be limited to a lower number. You may lose money.

But commercial real estate is valued entirely differently. It is based on math. The value of commercial real estate equals the net operating income divided by the capitalization rate.

The net operating income is the gross operating revenues (mainly rents) minus operating expenses. It is primarily in the control of (or can be influenced by) the owner/asset manager.

The capitalization rate (cap rate) is loosely defined as the unlevered rate of return on an asset that investors expect for particular location, size, and condition. This number reflects the risk of the asset, and often it ranges between about 4% and 10%. The cap rate is primarily based on the market’s opinion and typically minimally under the control of the owner/asset manager.

In our opinion, because operators can usually drive increased income, they can influence appreciation. This means they have more influence over property values and, thus, their wealth than the typical residential real estate investor.

(This is a brief summary of a big topic. For a more detailed explanation, check out the Introduction to Commercial Real Estate Investing eBook and eCourse at www.wellingscapital.com/resources.)

Free Download ↓

Invest with Confidence

Get your FREE Due Diligence Checklist for Passive Real Estate Investors Today!

Commercial Real Estate Has Significant Barriers to Entry

For these reasons, we think commercial real estate is important to include in an investor’s portfolio. But unfortunately, for most investors, there are significant historical barriers to entry that can keep us out.

Most investors don’t have an inside track with sellers and brokers. Most don’t have access to millions in liquid capital or investor funds for equity. Lenders want to see a high net worth, liquid cash, and that pesky thing called a track record.

But these barriers have been largely overcome for most investors over the past half-century. There are at least three widely available avenues for most investors to passively invest in commercial real estate.

Three Paths to Passively Invest in Commercial Real Estate

Active commercial real estate investors acquire, fund, and manage their own assets. The vast majority of investors, however, gain access to commercial real estate through three major avenues: publicly traded REITs, private one-property syndications, and private funds.

#1: Publicly traded Real Estate Investment Trusts (REITs)

Congress created Real Estate Investment Trusts about 60 years ago to give individual investors access to invest in income-producing real estate. REITs sell shares of stock to finance their assets and are available as publicly traded and private securities. As of October 2022, there are approximately 170 publicly traded REITs.

There are at least two major publicly traded REITs that acquire and operate manufactured housing communities, RV parks, and marinas: Sun Communities and Sam Zell’s Equity Lifestyle Properties.

While REITs have great advantages for investors, there are also significant disadvantages.

Investors like the benefit of access to an extensive portfolio of professionally managed assets. These companies are carefully managed with audited financials, SEC oversight, and great controls in place. They can afford to acquire assets at a scale that most privately run operators could only dream of.

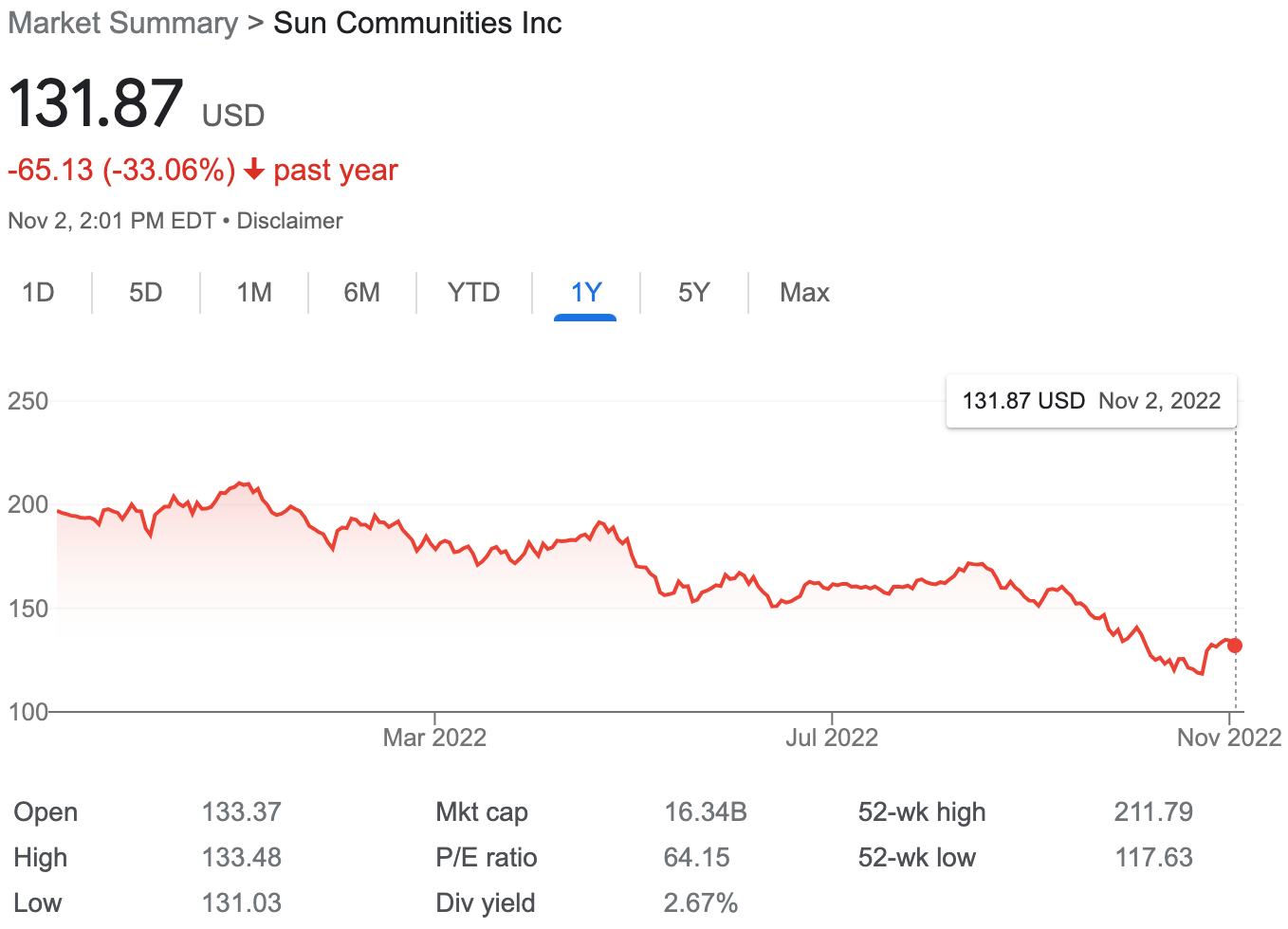

On the downside, many large investors don’t like the fact that their returns can be subject to the mood on Wall Street, a CEO scandal, or a war in Ukraine. Equity Lifestyle Properties (ELS) increased its revenue dramatically in the past year. Yet its stock price has fallen about 17%. Sun Communities (SUI) has lost over 23% in this same period.

The data for ELS and Sun above was pulled from Google on November 2, 2022.

Not to be Captain Obvious or Mr. Critical, but did you notice the striking pattern similarity in the two one-year graphs? So, can we infer that operations and value are mysteriously going up and down on the same days and weeks at each independent company? Of course not.

Also, note the annual dividend yield of about 2.6% for each. Many private syndications and funds project and pay investors at rates of 5%-8% or more annually, more than double the current yield of ELS and SUI.

Investing in publicly traded or private REITs usually involves high fees that include investment banks, broker commissions, and the costs of compliance and audits, in addition to the expected costs to acquire and manage a portfolio of properties.

REITs typically provide annual 1099s to investors. However, many investors prefer private investments that directly pass paper losses through to investors on a K-1 tax return instead.

Perhaps most troubling, it can be difficult to see the path between improvements at the property level to the change in my dividends and stock price. It can be much more apparent in a smaller, privately held property or fund.

#2: Invest in a private commercial real estate property

A second option for passive investors is to invest in a privately-owned real estate syndication. A syndication allows a group of passive private investors to pool their funds together to acquire a commercial real estate asset. These syndicates are typically managed by an experienced active manager, whose role is to acquire and operate an asset on behalf of the group.

These managers acquire and are responsible for the debt and all operations. Passive investors put up the cash to provide equity and trust the asset manager/operator (aka syndicator) to do the heavy lifting and provide income and appreciation. Syndicators typically receive an acquisition fee as well as asset and property management fees.

Syndicates are usually structured to pay income, refinance proceeds, and appreciation to passive investors first. The syndicator profits only after specific cash flow and growth hurdles are surpassed. In exchange for trusting the syndicator and putting up the equity, passive investors typically receive the lion’s share of cash flow and appreciation from these projects.

Though it ranges widely, passive syndication investors have often enjoyed tax-advantaged cash flow of about 4% to 8% or more over the past decade. In addition, syndications may also return capital to passive investors through excess income or refinance events.

Investors often receive total annual returns or IRRs in the mid-teens or higher upon the sale of these properties. A five-year multiple on invested capital (MOIC) of 2.0x or better is not uncommon (investor equity doubles in ~ five years, representing an annual return of ~ 20%).

The IRS treats passive syndication investors as limited partners, which means they experience the tax benefits created by accelerated depreciation. This often means investors receive cash flow, but enjoy income tax deferrals for a number of years. Certain investors can even utilize these losses to offset W-2 or 1099 income from their profession.

Syndication investors must often dig for information on these investments. Unfortunately, promotion, projections, reports, and data are not standardized or heavily regulated by the SEC in most cases. This can result in a tradeoff between higher risk for higher potential returns in these investment vehicles.

I love investing in syndications! Syndications can provide investors with superior cash flow and risk-adjusted returns. Some investors have made real estate syndications a substantial portion of their portfolios.

But syndication investing carries real risk. If you plan to invest, it’s critical that you do extensive due diligence to confirm the operator’s skill and the particulars of the asset. Don’t take this lightly. There will not be an array of investment bankers and analysts to guide you.

And unlike REITs, which typically offer diversification across geographies and projects, syndication investors usually focus their prospects on a single asset in one location.

Is there a solution combining many of the advantages of passively investing in REITs and syndications? Perhaps…

#3: Invest in a private real estate fund

A syndicated commercial real estate fund allows passive real estate investors pooled access to syndicated real estate operators. (But these funds are not without their downsides.) A syndicated real estate fund takes one of two forms:

Single Operator Fund: An operator puts together a portfolio of syndicated deals into one fund. These funds provide diversification across different properties and geographies within one (or a few) asset class(es). Many investors like having access to multiple properties through one operator. There can be risk because these funds do not diversify operators and may be focused in asset classes and strategies.

Fully Diversified Fund: A manager creates a fund with multiple commercial asset classes, vetted operators, geographies, strategies, and properties. Investors get the benefits of diversification and rely on a fund manager to carefully select individual syndicators.

Passive investors don’t have to do the heavy lifting to pick individual asset classes and operators since they trust a professional’s team to do that. Investors don’t have to monitor the ongoing progress or potential asset liquidations and returns since they trust the professional’s team to do that as well. But, of course, these investors realize the professional team doesn’t do this for free.

My firm, Wellings Capital, specializes in commercial real estate and appreciates all these investment vehicles. Based on the benefits of this last strategy and our skill set, we have chosen to manage a number of diversified funds.

Here are some features of a fund like this in comparison to the options described in this post:

Investors get access to the commercial real estate’s historical cash flow and appreciation

These funds provide investors with virtual ownership without the heavy lifting of acquisition, debt, and property management

Investors may achieve pass-through tax benefits (accelerated depreciation) via a K-1

Yield projections may exceed those of many REITs

Cash flow, value, and appreciation are generally traceable to asset performance, not the daily mood on Wall Street

Can provide diversification across asset classes, operators, geographies, strategies, and properties

The fund is managed by a team that performs due diligence to select and monitor asset classes and operators

The fund may have access to better terms from operators seeking a larger investment check

The fund may have access to investments that are not publicly advertised or those with a high minimum

A fully diversified fund has some potential disadvantages as well. These include:

There may be an extra layer of fees and splits from the fund manager

Investors may need to file tax returns in multiple states

K-1 tax forms tend to arrive later than those from individual syndicators and single-operator funds

Free Download ↓

Invest with Confidence

Get your FREE Due Diligence Checklist for Passive Real Estate Investors Today!

Conclusion

If you have any further questions about the various options discussed in this article, please email us at invest@wellingscapital.com or use this link to set up a call.

DISCLAIMER: Past performance is not indicative of future results. There is no guarantee that any forecasts or projections will be achieved. Any investment involves significant risk, including the possible loss of principal. Investors should carefully consider the investment objectives, risks, charges, and expenses of any Wellings Capital Management, LLC (“Wellings”) investment program. Offering documents containing this and other important information are available by calling 800.844.2188, emailing invest@wellingscapital.com, or visiting wellingscapital.investnext.com.

The information in this article is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction where such an offer or solicitation would be unlawful. Wellings is an SEC-registered investment advisor, however Wellings does not provide tax, legal, or accounting advice. Investors should consult their own advisors regarding any investment. Information and any opinions contained in this article have been obtained from sources that we consider reliable, but we do not represent that such information and opinions are accurate or complete and thus should not be relied upon as such.